Watchlist Screening AML - Prevent Money Laundering Risks

Detect Potential

Money Laundering

Faster

Our Watchlist Screening helps your business avoid risky illegal activities by assessing the potential risks of potential customers.

Trusted by companies all over the world

The Importance of Complying with

Anti-Money Laundering (AML) Rules Correctly

Prevent Heavy Fines and Legal Sanctions because of violating AML and CFT rules

Risk of damaging company reputation in front of investors, business partners, and the public

Your company risks becoming a vehicle for money laundering and terrorism financing

Why Watchlist Screening

is the Right Choice?

Integrated Database

Trusted Global Database

Data includes criminal identities, suspected terrorists, individuals sanctioned, and political figures.

ISO 27001 Certified

Data security is guaranteed with international standards.

Recheck Requested Data

Free of Charge

Helps you detect users in real-time

Easy and Fast

Integration into System

Can be directly connected to the system without integration fees

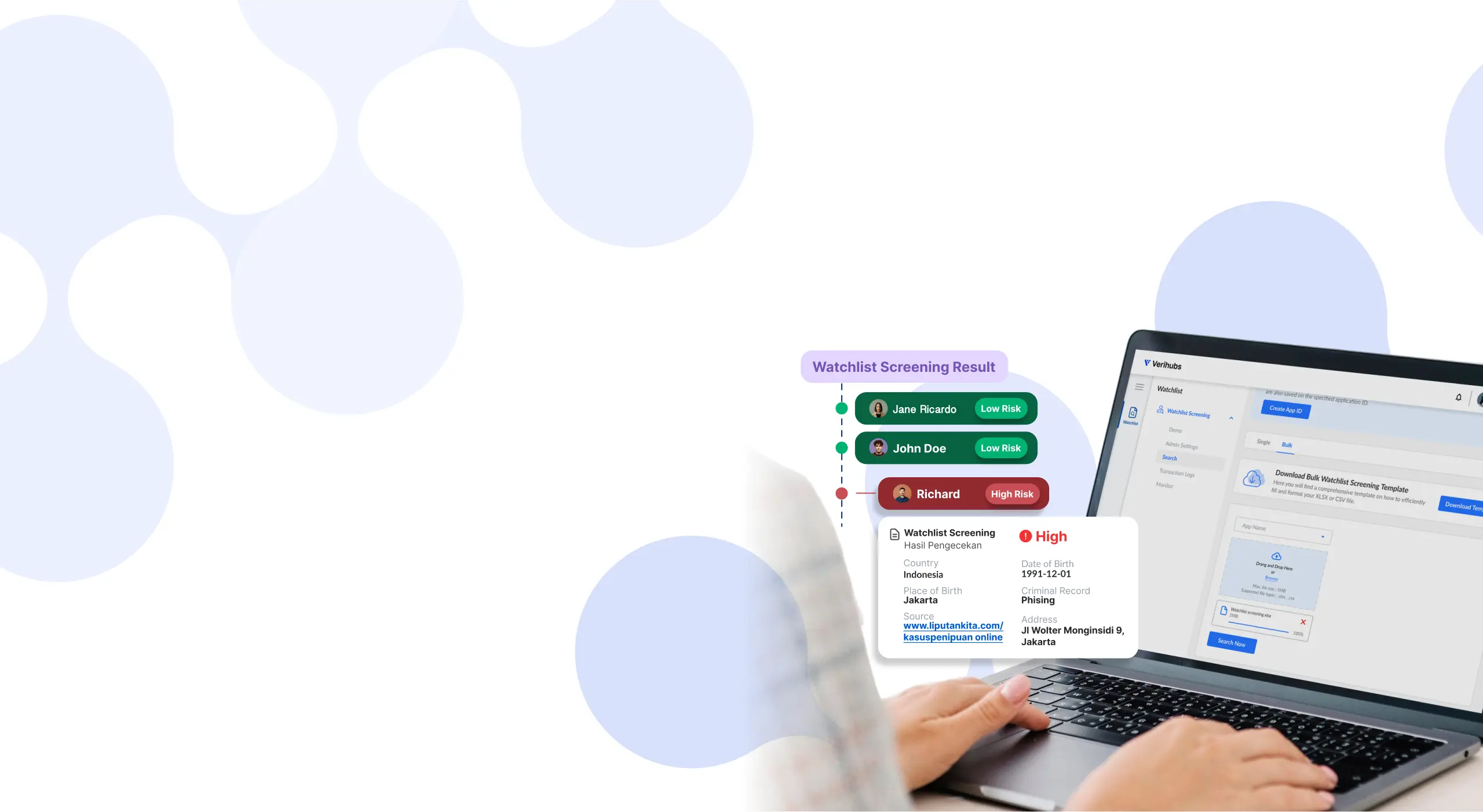

How Watchlist Screening Works

Fill in customer information, including name, place and date of birth, and country.

The system checks customer data against local and global watch lists

The system provides a risk value if there is a match with the database regarding background checking

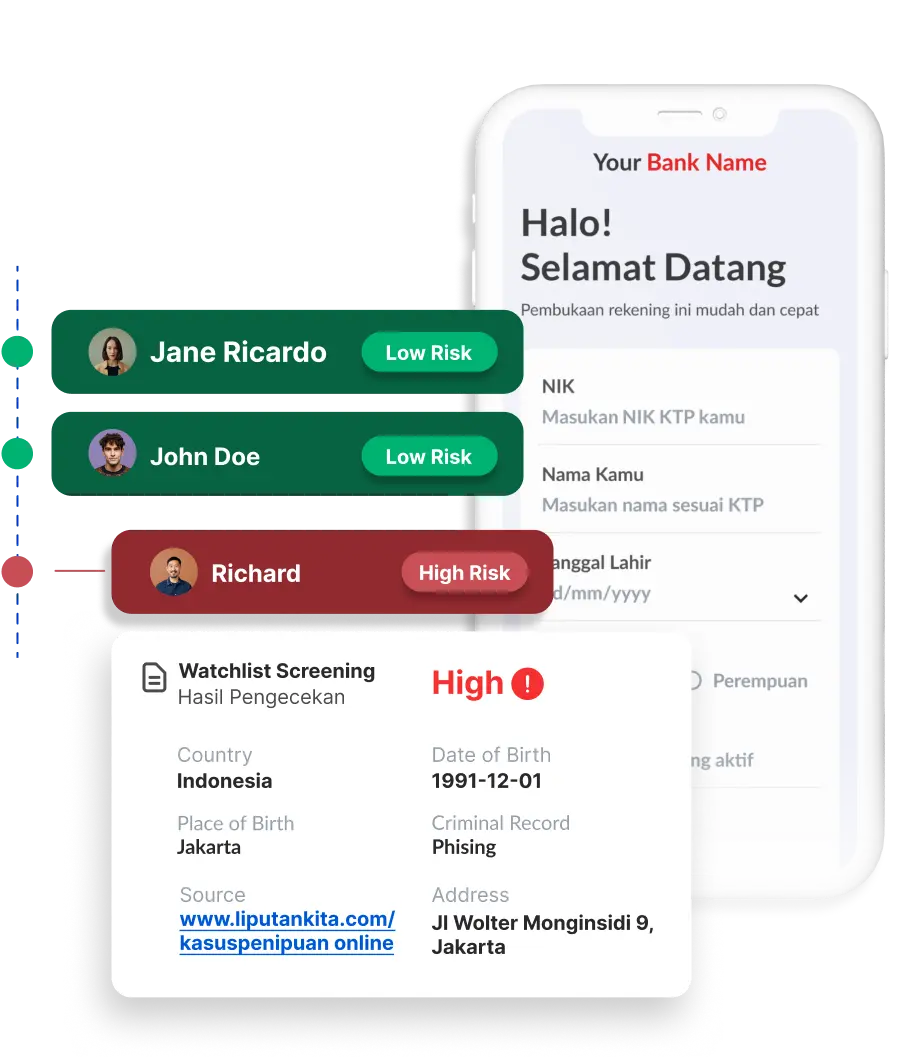

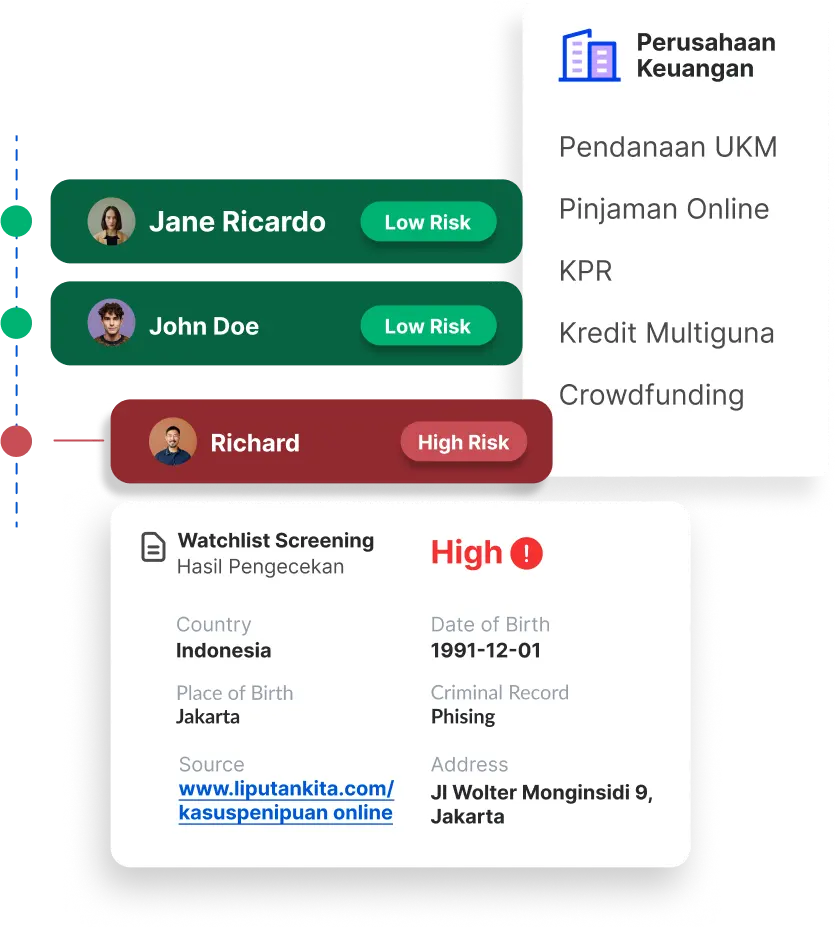

Application of Watchlist Screening

in Various Industry Segments

Usage Scenario

Verify Prospective Customer Data

When registering, prospective customers data will be screened to determine their track record of criminal or illegal activities.

Checking Data Before Making a Transaction

Watchlist Screening assesses the legal history of potential customers before each transaction is made

Frequently Asked Questions (FAQ)

Trusted by 400+ clients

and experience faster,

smarter verification with us

and experience faster,

smarter verification with us